The LG Electronics IPO has captured significant attention in the stock market, with investors keen to understand the allotment process, subscription figures, and how to verify their application status online. This article dives deep into the IPO subscription statistics, allotment details, and step-by-step instructions to check your status.

What is an IPO?

An Initial Public Offering (IPO) is the first sale of a company’s shares to the public. Companies like LG Electronics use IPOs to raise funds for expansion, debt repayment, or strategic investments.

Investors participate in IPOs to potentially gain from the company’s growth and the market value appreciation of shares. Understanding the allotment process and subscription figures is crucial for investors to plan future investments.

LG Electronics IPO Overview

The LG Electronics IPO has been highly anticipated due to the company’s established reputation in the consumer electronics sector. Key details of the IPO include:

| Parameter | Details |

|---|---|

| IPO Name | LG Electronics Limited |

| Issue Type | Book Building |

| IPO Size | ₹X,XXX Crores |

| Face Value | ₹XX per share |

| Price Band | ₹XXX – ₹XXX per share |

| Issue Open Date | DD-MM-YYYY |

| Issue Close Date | DD-MM-YYYY |

| Lot Size | XX shares |

| Minimum Investment | ₹XXXX |

| Listing Date | DD-MM-YYYY |

| Stock Exchange | NSE & BSE |

Note: Exact numbers can vary. Investors should always confirm from the official prospectus or reliable financial sources before investing.

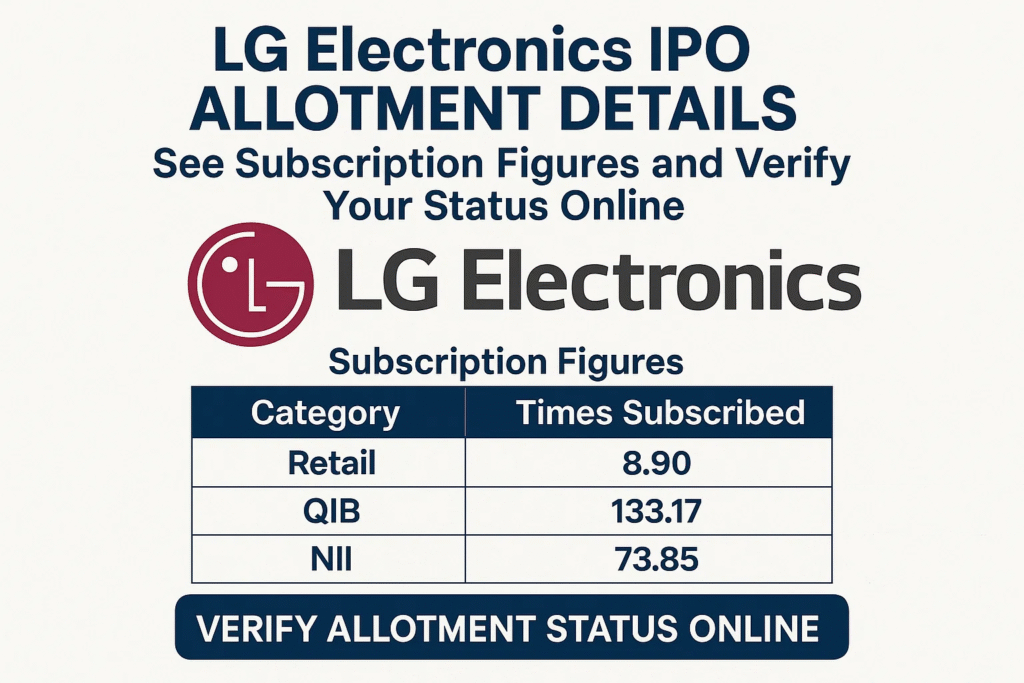

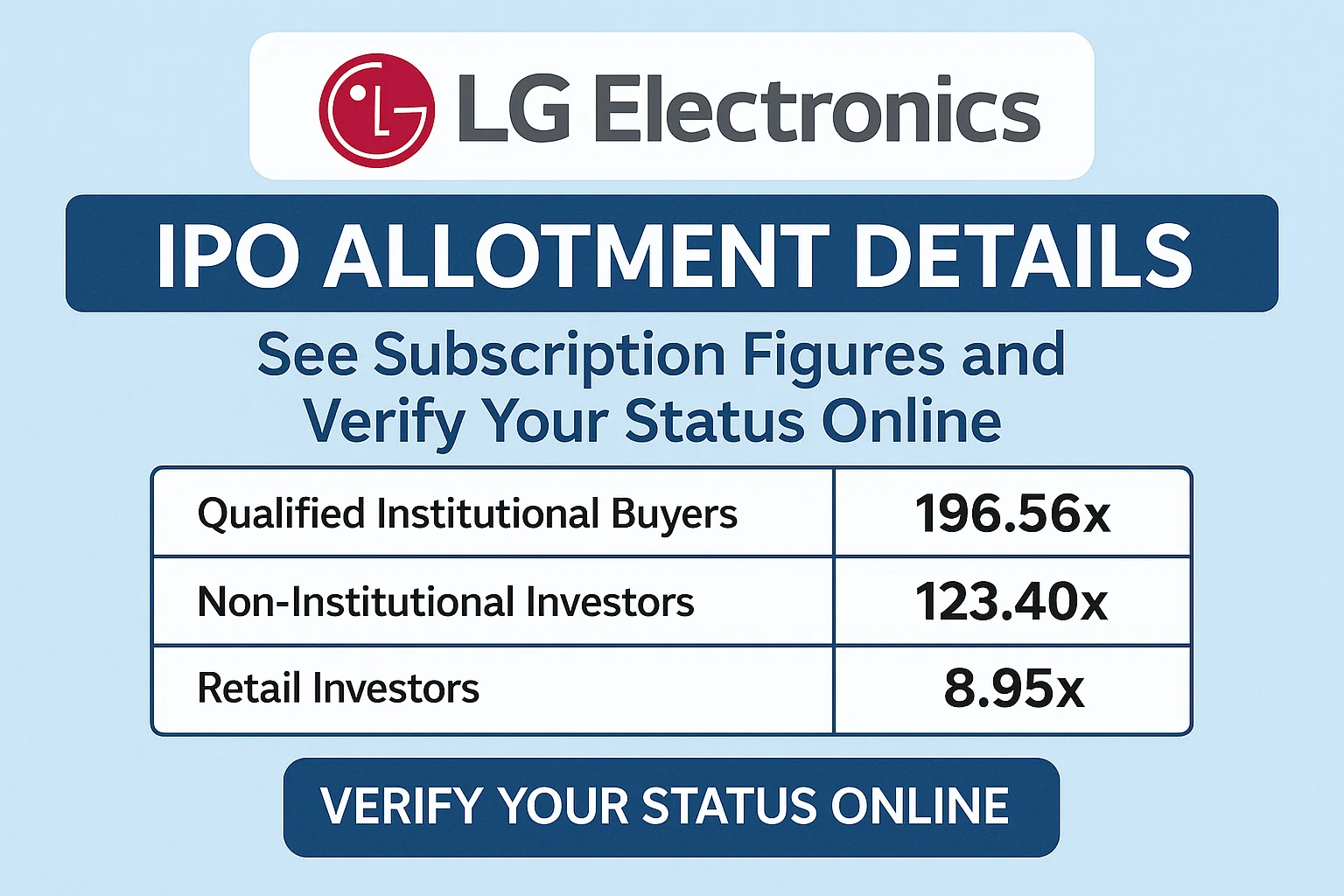

Understanding IPO Subscription Figures

Subscription figures indicate the demand for shares in an IPO. They are classified into three main categories: Retail, Qualified Institutional Buyers (QIB), and Non-Institutional Investors (NII).

| Category | Subscription Status |

|---|---|

| Retail Investors | X.XX times |

| Qualified Institutional Buyers (QIB) | X.XX times |

| Non-Institutional Investors (NII) | X.XX times |

| Overall Subscription | X.XX times |

Key Insights:

-

Retail Investors: These are individual investors applying in small quantities. High retail subscription shows strong public interest.

-

QIBs: Institutional investors like mutual funds, banks, and insurance companies. They usually bid for large quantities.

-

NIIs: Non-institutional investors are high-net-worth individuals applying above the retail limit.

A higher subscription ratio means more competition and potentially a lower chance of allotment for individual investors.

LG Electronics IPO Allotment Process

The allotment of IPO shares is governed by SEBI regulations and follows a transparent, fair lottery system. The process can be summarized as:

-

Applications Received: Investors submit their applications via brokers or online platforms.

-

Segregation: Applications are divided into retail, institutional, and high-net-worth categories.

-

Allotment Lottery: If subscriptions exceed available shares, a randomized lottery decides allotment for retail investors.

-

Refunds: Unsuccessful applications get refunds, usually credited within a few working days.

-

Listing: Allotted shares get credited to the demat accounts and are listed on the stock exchange.

| Step | Action |

|---|---|

| Step 1 | Investor submits IPO application |

| Step 2 | Application categorization (Retail, NII, QIB) |

| Step 3 | Lottery/allotment process if oversubscribed |

| Step 4 | Refund processing for non-allotted shares |

| Step 5 | Shares credited to demat accounts and listed |

How to Verify LG Electronics IPO Allotment Status Online

Investors can verify their IPO allotment status through various methods provided by SEBI-registered entities. Here’s a step-by-step guide:

Step 1: Check via Broker/Bank

Most investors apply through banks or stock brokers. You can log in to your account and view the IPO section to see the status.

Step 2: Check via Registrar

The IPO registrar maintains the allotment record. You can enter details like PAN, application number, or DP ID to check allotment.

| Method | Required Details | Steps |

|---|---|---|

| Bank/Broker | Login credentials | Navigate to IPO section → Select LG Electronics → Check status |

| Registrar | PAN, Application Number, DP ID | Visit registrar portal → Enter details → Submit → Check allotment status |

| NSE/BSE Website | PAN, Application Number | Go to IPO allotment section → Enter details → Check status |

Step 3: Demat Account

Allotted shares are automatically credited to the investor’s demat account, which can be checked through your DP login portal.

LG Electronics IPO Timeline (Estimated)

Understanding the IPO timeline is essential for tracking applications and allotment updates.

| Event | Date (Tentative) |

|---|---|

| IPO Opening | DD-MM-YYYY |

| IPO Closing | DD-MM-YYYY |

| Basis of Allotment Announcement | DD-MM-YYYY |

| Refunds Initiated | DD-MM-YYYY |

| Credit of Shares to Demat | DD-MM-YYYY |

| Listing on NSE/BSE | DD-MM-YYYY |

Note: Dates may vary depending on regulatory approvals and stock exchange schedules.

Tips for Retail Investors

-

Apply Early: Avoid last-minute submissions to prevent application errors.

-

Check Eligibility: Ensure your demat and bank accounts are active.

-

Understand Lot Size: Apply multiples of the minimum lot size.

-

Diversify Applications: Avoid putting all your funds into one IPO; diversify across sectors.

-

Track Subscription: High oversubscription may reduce chances of allotment.

How Oversubscription Affects Allotment

Oversubscription occurs when the demand exceeds the shares offered.

| Category | Oversubscription Impact |

|---|---|

| Retail | Allotment via lottery; small portion may get full lot |

| NII | Partial allotment based on proportion |

| QIB | Often fully allotted due to high demand and allocation preference |

High oversubscription does not guarantee success but reflects strong market confidence.

Common Queries About IPO Allotment

Q1: How is the allotment decided for retail investors?

A1: Through a computerized lottery system, ensuring fairness when shares are oversubscribed.

Q2: What happens if my application is rejected?

A2: The amount blocked in your bank account is refunded, typically within a few working days.

Q3: Can I sell allotted shares immediately?

A3: Once shares are credited to your demat account and listed, you can sell them on the stock exchange.

Q4: How to know the exact number of shares allotted?

A4: Check your demat account statement or the registrar’s allotment portal using PAN and application number.

Sector Performance & IPO Significance

LG Electronics operates in the consumer electronics and home appliances sector, which has seen consistent growth due to rising technology adoption and smart home solutions. The IPO represents an opportunity for investors to participate in this expanding market.

| Parameter | Current Trend |

|---|---|

| Market Demand | Increasing |

| Technology Adoption | Smart home appliances gaining popularity |

| Investor Interest | High due to LG brand value |

| IPO Subscription | Strong, especially in retail segment |

Conclusion

The LG Electronics IPO provides a promising opportunity for both retail and institutional investors. By understanding the subscription figures, allotment process, and verification steps, investors can make informed decisions.

Remember, IPO investments carry risk, and it is crucial to assess the company fundamentals, sector performance, and your own investment goals before applying.

By following this guide, investors can confidently track their IPO allotment status and stay updated on important timelines.